Premier Wayne Panton announced a plan to raise property values for full stamp duty exemptions for Caymanian first-time home buyers.

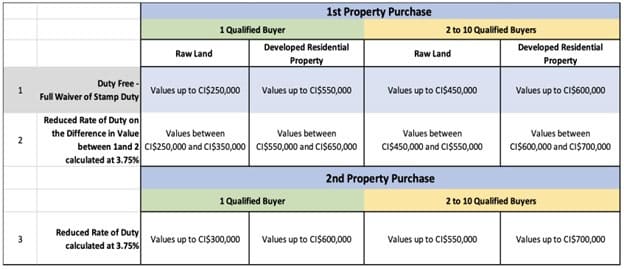

For a first-time single Caymanian buyer, stamp duty will be exempt on properties valued at up to $550,000, and for raw land valued at up to $250,000.

Previously, the stamp duty exemption applied to properties valued at $400,000 or less and to land valued at $150,000 or less.

The premier stated that where the property value of a residence is above $550,000 but less than $650,000, stamp duty will be assessed at 3.75% on the difference above $550,000. For land, where the value is above $250,000 but less than $350,000, stamp duty will be assessed at 3.75% on the difference above $250,000 only.

Panton stated that Cabinet had approved the stamp duty concessions on 18 Sept.

In a statement to the House on Friday, he said the move would increase the value of existing thresholds, restrict the concession to the purchase of ‘raw land’ or residential property, and introduce a new concessionary tier for Caymanians purchasing their second property.

Panton told legislators that for some Caymanians, it seems “next to impossible” to buy land or a home in Cayman.

“Prices for a modest three-bedroom home in the eastern districts have been steadily rising for years,” he said. “Even if you’re lucky enough to find a home in the $485,000-$500,000 price range, at 20% you’d still need a $97,000 down-payment to access a mortgage. Can you imagine how hard it is to find that amount of money as a single mother with three children, or as a young couple or even as a single person?

“And even if you manage to get the money together for a down-payment, who will help find even more money to pay the thousands and thousands of dollars you’ll need for the stamp duty? Who will help? We will. Under my leadership, this government will.”

As well as raising the property values for stamp duty exemptions for first-time Caymanian property buyers, the expanded concessions also provide a reduced rate of stamp duty for properties valued above the fully exempt thresholds, and offers a new benefit for Caymanians purchasing a second property.

Other concessions

Under the announced plan, for a group of two to 10 Caymanians purchasing their first parcel of land together, there will be no stamp duty assessed on values up to $450,000. Previously, the amount had been $300,000.

Where the property value is above $450,000 but less than $550,000, stamp duty will be assessed at 3.75% on the difference above $450,000.

For a group of two to 10 Caymanians purchasing their first home or developed residential property together, there will be no stamp duty assessed on values up to $600,000 – a $100,000 increase on the previous amount. Where the property value is above $600,000 but less than $700,000, stamp duty will be assessed at 3.75% on the difference above $600,000.

The changes also formalise an avenue for Caymanians purchasing their second property to qualify for a discounted stamp duty rate.

For a Caymanian purchasing a second parcel of raw land, stamp duty will be assessed at 3.75% on values up to $300,000.

For a Caymanian purchasing their second home or developed residential property, stamp duty will be assessed at 3.75% on values up to $600,000.

For a group of two to 10 Caymanians purchasing a second parcel of land together, stamp duty will be assessed at 3.75% on values up to $550,000.

For a group of two to 10 Caymanians purchasing a second home or developed residential property together, stamp duty will be assessed at 3.75% on values up to $700,000.

In his address to Parliament, Panton said these concessions could be introduced without having a significant impact on the government’s financial position.

The changes and additions to the Caymanian property buyers stamp duty concessions are outlined in the following table:

Immediately available

Panton said, “To be sure, these concessions will increase the number of Caymanians who are able to afford their first (or second) homes and make it easier for hard-working Caymanian citizens and families to be able to purchase property.”

The enhanced stamp duty benefits will be offered to Caymanians immediately, with the premier acting in his capacity as Minister of Finance and Commissioner of Stamp Duty to exercise the powers under section 20(6)(a) of the Stamp Duty Act (2019 Revision) to grant the concessions.

A press release on the concessions noted that the process for the legislative amendments “is a thorough but lengthy one but when completed will ensure that these valuable benefits are available for all Caymanians purchasing their first or second properties without being subject to the discretion of anyone”.

ORIGINALLY PUBLISHED IN THE CAYMAN COMPASS. Click to read original article.